A new report by the Swiss NGO SWISSAID has described South Sudan’s gold sector as highly informal and illegal, with production entirely dominated by unregulated artisanal mining and all exports believed to be smuggled out of the country.

The report, titled “African Gold Report: South Sudan,” states that a lack of official statistics and effective governance makes it impossible to know the true scale of the trade.

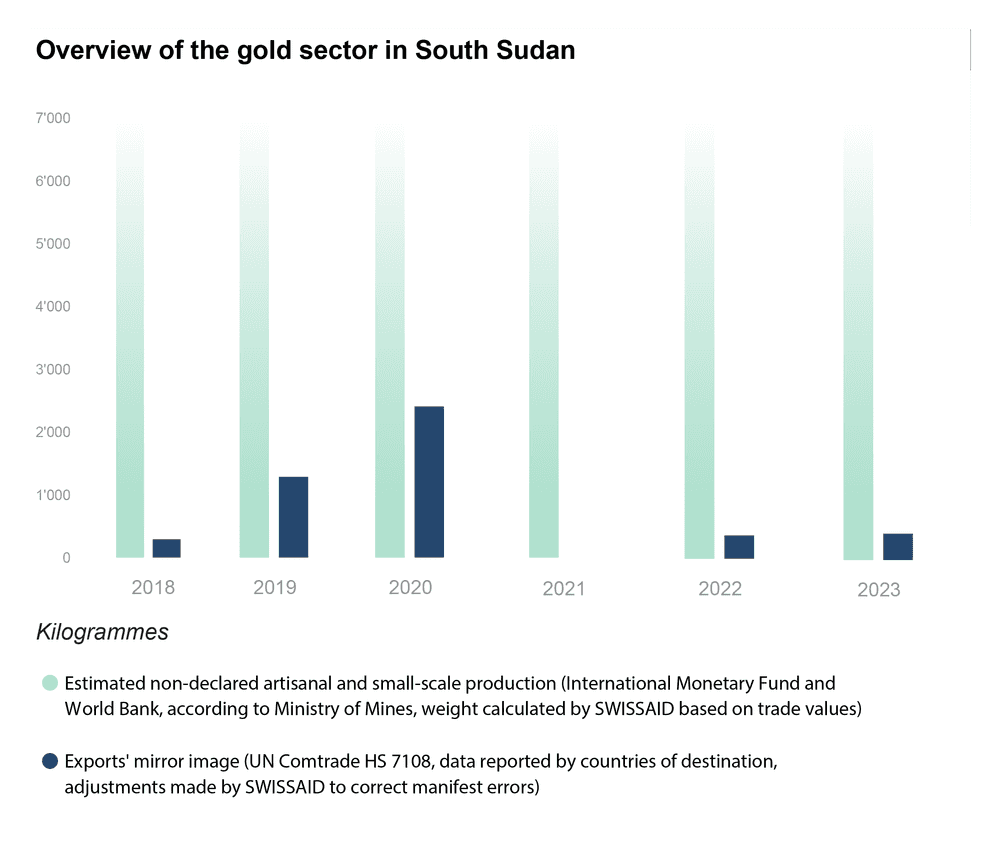

However, based on estimates from the International Monetary Fund and World Bank, SWISSAID suggests that approximately five tonnes of gold, worth hundreds of millions of dollars, may be produced and smuggled out annually.

“According to the most plausible estimate of gold production in South Sudan, SWISSAID was able to identify, i.e., approximately 5 tonnes per year, the country represents a medium-size gold producer by African standards,” the report says. “This production derives exclusively from artisanal and small-scale mining (ASM), which is performed informally, often under the control of armed groups, and using basic tools and equipment, leaving many miners exposed to exploitation and great health and security risks.:

“The long civil war in South Sudan, which officially lasted from 2013 until 2018, but whose end has not brought real peace or fully eliminated violence, has impoverished the population and hindered the building of basic infrastructure such as paved roads. As a result, the conditions for the development of industrial mining are lacking,” it adds.

South Sudan is thought to have abundant mineral resources, but their geological mapping has yet to be achieved.

“All the gold extracted in South Sudan is eventually exported outside formal channels. Smugglers, many of whom are reportedly foreigners, benefit from weak law enforcement and the complicity of some corrupt representatives of state authorities,” the report says. “There are indications that national and foreign armed groups are also involved in this traffic, which points to the use of South Sudanese gold for conflict financing.”

Exploitative Production

According to the analysis, gold mining in South Sudan is exclusively artisanal and small-scale. Miners use basic tools without mechanisation or chemicals like mercury, leaving them exposed to significant health and safety risks.

The sector is characterised by exploitation, with miners receiving low prices for their gold due to the volatile South Sudanese pound and unattractive official exchange rates. This drives the trade towards the black market.

The report released on 21 November details that armed groups, including state and non-state actors, are heavily involved in the sector, often controlling mining sites and demanding a share of production or informal taxes.

A Transit Hub for Regional Gold

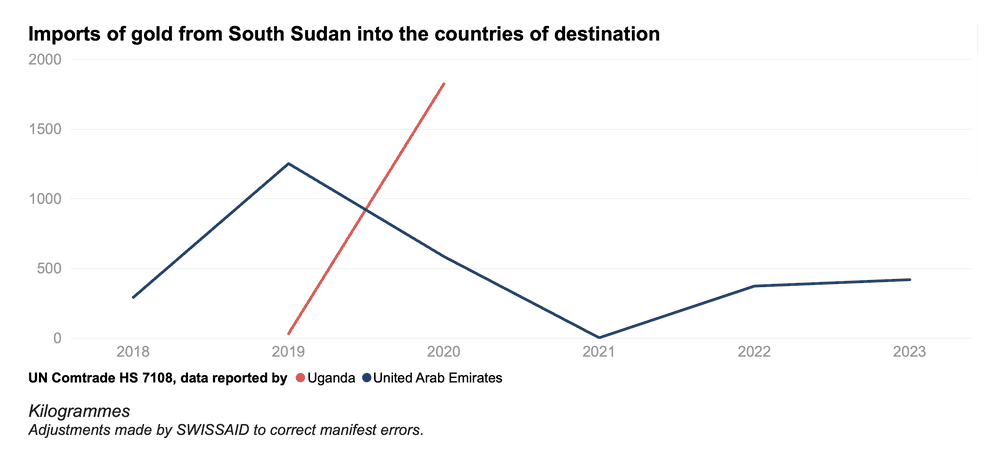

The report also highlights that South Sudan has become a transit hub for gold smuggled from other conflict-affected countries. Since the outbreak of civil war in Sudan in April 2023, gold from that country has been entering South Sudan before being flown to the United Arab Emirates (UAE).

Ugandan and Kenyan authorities are also implicated in the regional gold traffic, the report says.

Key Destinations: UAE and Uganda

With no official exports declared by South Sudan, the report relied on import data from other countries to trace the gold’s journey. The UAE and Uganda were the only nations to report official gold imports from South Sudan in recent years.

The UAE reported imports worth $20 million in 2022 and $27 million in 2023. However, the report suggests that known destinations like Kenya and China do not appear in the official trade data, indicating that the graphs represent only a fraction of the actual flows.

Smuggling is facilitated by porous borders, weak law enforcement, and the complicity of corrupt officials, the report concludes.\

Failed Reform

Despite having a legal framework, including a Mining Act from 2012, South Sudan’s government has failed to regulate the sector effectively, the report says.

It points out that attempts to purchase gold from miners at fixed prices to boost the economy have been unsuccessful, often backfiring and pushing prices higher on the black market.

While there is potential for industrial mining, the report notes that decades of conflict have left the country without the necessary infrastructure, such as paved roads. A kleptocratic political regime has also deterred major international investment, the report added.

The South Sudanese Ministry of Mining could not immediately be reached for comment on the findings of the report.

Read the whole report here https://africangoldreport.org/south-sudan.