South Sudan is losing significant revenue due to outdated and low tax rates, particularly on maize flour imports, a senior revenue official said on Thursday during a public hearing on the 2025/2026 budget.

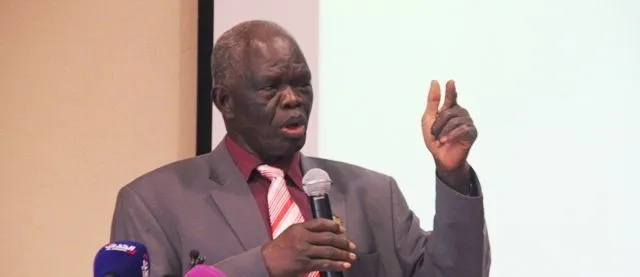

Aggrey Tisa Sabuni, technical advisor for revenue matters at the South Sudan Revenue Authority, told lawmakers that the continued application of a 5% import duty on maize flour — a rate set in 2002 — has undermined domestic revenue mobilisation and weakened the country’s position within the East African Community (EAC).

He said taxation is central to sustaining the social contract between citizens and the state, describing the Finance Bill as the main instrument for raising revenue and implementing government policy.

“Taxation serves two purposes all over the world: raising sufficient revenue to enable the government to deliver its part of the social contract, and implementing government policies,” Sabuni said.

EAC obligations

Sabuni reminded lawmakers that South Sudan, having domesticated the EAC Treaty, is bound by its protocols, including the Customs Union and the Common External Tariff (CET).

Under the CET framework, raw materials attract zero percent duty, semi-finished goods 10%, finished products 25%, and sensitive items 35%.

However, Sabuni said South Sudan’s import duty on maize flour remains at 5%, far below the 25% charged by most EAC partner states. Ethiopia charges 35% and Sudan 40%, he added.

“If you look at these rates, year in and year out, since we started publishing the Finance Bill, they never change — 5%, 5%, 5%,” he said, questioning whether such a rate can sustain national development.

The 5% rate was introduced in 2002 in Rumbek during the civil administration of then SPLM-controlled areas and has not been revised since independence in 2011, he said.

Budget and reserves

Sabuni, who formerly served as finance minister, compared South Sudan’s budget performance with other EAC member states, arguing that low revenue collection has constrained public spending.

South Sudan’s 2024/2025 budget stood at about $1 billion, while Uganda collected roughly $20 billion in tax revenue, Kenya $30 billion, Tanzania $18.8 billion, Rwanda $3.7 billion and Burundi $1.5 billion, he said.

For the 2025/2026 financial year, South Sudan’s budget is projected at around $1.5 billion, compared to Kenya’s $33 billion, Uganda’s $20 billion, Tanzania’s $22 billion and Rwanda’s $5 billion.

He added that foreign exchange reserves remain critically low.

“South Sudan’s reserves are $74 million, equivalent to half a month. Not even one month,” he said, contrasting this with Uganda’s $5.4 billion, Kenya’s $12.5 billion, Tanzania’s $6.3 billion and Rwanda’s $2.4 billion.

Impact on agriculture

Using maize flour as an example, Sabuni argued that low import duties send the wrong policy signal at a time when the government has repeatedly pledged to prioritise agriculture.

“Domestically, we are telling our farmers not to farm,” he said, warning that cheap imports discourage local production.

His remarks come amid broader concerns over liquidity challenges and structural weaknesses in the oil-dependent economy.

Benjamin Ayali Koyongwa, undersecretary for planning at the finance ministry, echoed the call for reform, saying tax rates need to be revisited to support development.

“For sufficient development to happen in our country, we need to revisit the taxing rates,” he said, adding that any revisions would seek to align South Sudan’s rates with those of EAC member states without undermining citizens’ purchasing power.

Business community concerns

However, business representatives raised concerns over the implementation of existing tax measures.

Asmerom N. Tuquabo, executive secretary of the Eritrean Business Community Chambers in South Sudan, said the enforcement of customs duties under the 2024/2025 Financial Act has created operational and credibility challenges.

He alleged that importers face additional charges not authorised by the Act, including trade accreditation fees, cyber security insurance, electronic cargo tracking fees and EAC clearing agents’ fees.

Tuquabo further claimed that although the Act stipulates a 5% customs duty, some importers are charged rates “five times higher”, raising what he described as credibility issues in the tax system.

He criticised what he called multiple tax assessments along the supply chain, saying they risk double taxation, delays and higher storage and demurrage charges that are ultimately passed on to consumers.

Tuquabo also pointed to foreign exchange pressures, saying businesses that trade in South Sudanese pounds are required to pay duties in U.S. dollars, despite limited dollar availability in the banking system.

“Our businesses trade in South Sudanese pounds and collect revenue in South Sudanese pounds, but they are asked to pay taxes in U.S. dollars,” he said.

On withholding tax, he said the current 20% rate on rental income exceeds regional benchmarks, citing Kenya’s 7.5% and Uganda’s 12%.

The draft 2025/26 budget must be debated and approved by parliament before it can take effect. It was tabled before lawmakers last week by Finance Minister Bak Barnaba Chol.

The proposed budget projects total expenditure of 8.58 trillion SSP against expected revenues of 7.01 trillion SSP, leaving a financing gap of 1.57 trillion SSP.